A group of 30 UK millionaires have called on the chancellor to tax them and other rich people more because they can afford to pay it and “the cost of recovery cannot fall on the young or on those with lower incomes”.

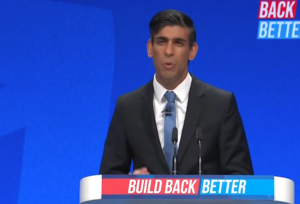

In an open letter in the run-up to the budget on Wednesday, the millionaires told Rishi Sunak to introduce a wealth tax on the nation’s richest people to help pay for the recovery from the coronavirus crisis and tackle the yawning inequality gap.

“We understand the immense pressure on the Treasury to deal with crises both present and future – from inequality, to Covid, to climate change. We know there will be high expectations for you to find the money needed,” the millionaires said in the letter.

“We know where you can find that money – tax wealth holders like us. We can afford to contribute more, and we want to invest in repairing and improving our shared services. We are proud to pay our taxes to reduce inequality, support stronger social care and the NHS, and to ensure that we’re building a more just and green society.”

The millionaire signatories, who cover multiple industries and backgrounds from across the UK, said they want Sunak to “address the economic imbalance of the current tax system which places a deeply unequal burden on working people”.

They said the planned 1.25 percentage point increase in national insurance contributions would “hit working people hardest”, so taxes on the wealthiest in society should be increased instead. The group called for the government to look at any policy that taxes wealth as a priority, ranging from the equalisation of capital gains with income tax, a review of property tax, to the introduction of a net wealth tax.

“The cost of recovery cannot fall on the young or on those with lower incomes. There are many of us – people with wealth – who will support a more progressive system of taxation, and we urge you to do the same,” the group, which is part of the Patriotic Millionaires movement, said in the letter. “When deciding on how to meet the financial gap, look to us. Repairing our country is more valuable than growing our wealth.”

They said the planned national insurance rise and the global elite’s tax avoidance tactics revealed in the Pandora Papers “demonstrate again how powerful and rich people benefit from a two-tiered tax system”.

As the cost-of-living crisis deepens and hits the UK’s poorest households, the combined fortune of UK billionaires has increased by 22% to £597bn since the start of the coronavirus pandemic.

One of the signatories, Gary Stevenson, a multimillionaire former City trader, said: “Instead of raising national insurance and taking £1,000 a year away from families on universal credit, the chancellor, who is a multimillionaire, should be taxing himself and people like me – people with wealth. We can’t expect to have a strong or stable recovery if the fiscal burden of it is placed on our care workers, street cleaners and teachers – key workers who deserve better – while we don’t tax the rich.”

The technology entrepreneur Gemma McGough, who also signed the letter, said it made economic sense to tax rich people more. “This letter isn’t a goodwill statement, this is an attempt to shake the chancellor by the fiscal shoulders and wake him up,” she said.

“If we endlessly tax working people and never tax where the big money is being made, our country will continue to suffer. Any business-minded person will tell you it makes good economic sense to balance your books. Where is the balance when wealth gets stockpiled by a small group of very rich people and the cost of the country falls to those on lower and middle incomes?”

A wealth tax on the top 1% of UK households – those with fortunes of more than £3.6m – could generate at least £70bn a year, according to research by Greenwich University. That would be equivalent to 8% of the current total tax take but affect only about 250,000 households.

Such taxes are beginning to be introduced in Argentina, Bolivia and Morocco to help pay for the recovery. In Norway, about 500,000 people pay an 0.85% charge on their assets above the value of about £125,000. The prospect of such a tax in the UK is rich people’s second biggest fear after the virus, according to Knight Frank’s wealth report. The prime minister, Boris Johnson, and Sunak have dismissed the suggestion.

Read more:

Millionaires petition Rishi Sunak to introduce wealth tax