Landytech, the company behind leading investment reporting platform, Sesame, today announced it has secured $12 million in Series B funding, led by an investment from Aquiline Technology Growth (‘ATG’) and additional investment from existing investor Adelie Capital.

This new capital raise follows on from the $6 million in Series A funding Landytech achieved in March 2021, recognising the rapid growth attained by the company in that time and its projected continuation.

The funding will accelerate Landytech’s growth, as the company expands internationally, and support its product development in partnership with its client base of single and multi-family offices, trustees, and asset managers. Landytech has clients in over 15 countries and has established more than 170 connections with custodians across the globe.

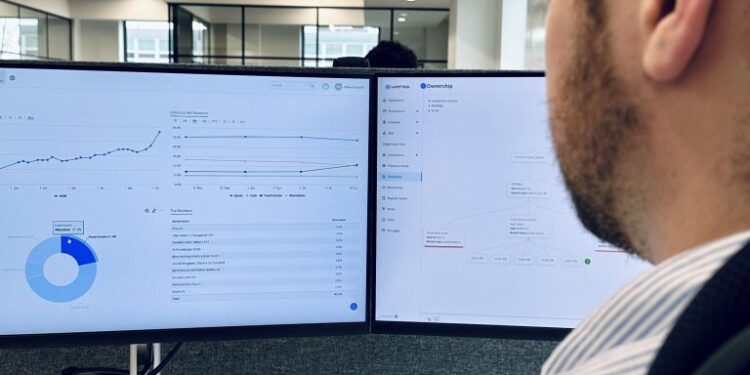

Landytech’s platform, Sesame, enables its clients to streamline reporting processes and make more informed investment decisions via a complete suite of investment data, analytics and reporting tools. It allows firms to seamlessly consolidate investment data across public and private assets, bringing it together on one platform. Its powerful analytics engine fuels decision-making by unlocking insights into performance drivers and detractors, along with exposures and risks, at portfolio level right through to individual assets. Sesame’s intuitive Report Builder allows firms to save time and bring investment data to life across complex allocations and entity structures, with fully customisable and templated reports, incorporating their own branding.

Benjamin Moute, CEO and Founder of Landytech commented: ‘’Landytech was created to revolutionise the way asset owners, investment managers and advisors access asset information. This funding represents a confidence in our go-to-market strategy and our vision to transform the way asset information is sourced and consumed. We chose to work with Aquiline owing to their unrivalled expertise at the intersection of financial services and technology. This relationship unlocks exciting opportunities as the company expands geographically and continues its development of an industry-leading platform. ’’

Jeff Greenberg, Chairman and CEO of Aquiline Capital Partners commented: “Family offices are a fast-growing segment of the wealth management industry with increasing complexity because of the proliferation of asset classes including private markets and alternatives, and the need for transparency and compliance has never been greater. Landytech’s software was built specifically to cater to the needs of this market, and we believe it is uniquely positioned to capitalise on this growth. WealthTech is a key area of focus for ATG and this funding reinforces the strength of its strategy: to support companies that impact the financial services sector. We look forward to partnering with the Landytech team as they enter this next stage.”

In 2022, Landytech saw a significant increase in revenue, with the company awarded Best Client Reporting Solution at the WealthBriefing Awards, alongside being named in the Fintech Global WealthTech 100. That year also saw the company grow to almost 100 members of staff, and the opening of a new flagship London office in South Kensington.

The post Landytech Secures $12 million Series B Funding from Aquiline Technology Growth first appeared on BusinessMole.