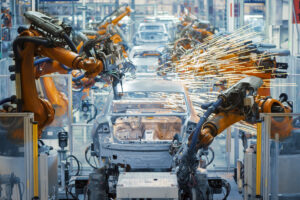

Five of the UK’s leading manufacturing industries have issued a plea for more government financial support to boost capital investment in research and development as well as new factories and equipment with lower carbon emissions.

Carmakers, aerospace, chemicals, pharmaceuticals and food and drinks manufacturers banded together on Wednesday to call for a long-term strategy for industry as the chancellor, Rishi Sunak, prepares for the budget next week.

Cutting industrial carbon output will be crucial to meeting the government’s legally mandated target of net zero emissions by 2050, and the manufacturers argue that they need government incentives to spend on decarbonisation.

The lobby groups said UK manufacturers needed help with energy costs, which can be as much as 80% higher than in some European countries. The UK is in the midst of an energy supply crisis, with high prices hitting manufacturers’ ability to make up for earnings lost during the pandemic.

Kevin Craven, the chief executive of ADS, the aerospace and defence group, said: “Manufacturing is essential to achieving net zero, ensuring our national economic resilience and providing rewarding careers.”

The UK economy is dominated by the services sector, and manufacturing accounts for only about 8% of value added to the economy – half its level in 1990. However, the manufacturing sector argues that it punches above its weight in terms of exports and high-wage employment.

The sector employs 800,000 people, with an annual turnover of £338.2bn and £166bn in exports, according to figures in a report from the Association of the British Pharmaceutical Industry, ADS, the Chemical Industries Association, the Food and Drink Federation and the Society of Motor Manufacturers and Traders.

Factories often provide a source of well-paid work in regions away from London, a key concern of Boris Johnson’s professed aim to “level up” poorer parts of the country.

The groups said a long-term capital grant facility worth 10% and 15% of the value of investments would help to attract significant new projects to the UK. Many large investments by multinationals already receive large government grants, but these are generally negotiated individually.

The report also argues that the government needs to modernise the system of tax credits for research and development (R&D). One key issue for manufacturers is that capital spending on things such as labs and buildings is not eligible for R&D tax relief. Sunak acknowledged the problem in March when he gave a temporary “super-deduction” for investment in plant and machinery, but that is due to last only two years.

The manufacturers’ analysis suggests that the tax cut would start to raise revenue within seven years because of the incentive to expand facilities and output. That move alone would create 12,000 jobs, they argue.

The manufacturers hope to capitalise on goodwill built up by the sector during the pandemic as factories quickly switched to making sanitiser, ventilators and, crucially, vaccines.

Steve Elliott, the chief executive of the Chemical Industries Association, said: “Manufacturing is essential to innovation, economic health, national resilience and security, as Covid-19 has clearly illustrated. It transforms laboratory research into new products and services, can generate finance for reinvestment and makes the world a better and safer place.”

Read more:

UK manufacturers plead for more government help to boost sector