The Treasury has unveiled plans to reward insiders who blow the whistle on tax avoidance or fraud, offering payments of up to 25 per cent of the extra revenue raised.

Inspired by a long-standing scheme in the United States, the government hopes this new incentive will encourage individuals working with wealthy clients or multinational firms to expose illicit practices.

In the US, whistleblowers have earned staggering sums: in the 2022-23 fiscal year, the Internal Revenue Service (IRS) paid out $89 million (about £68 million) to 121 informants, an average of over £500,000 each. Their tips helped the US government recover an additional $338 million (roughly £261 million) in tax, including a single case worth $263 million in which three individuals equally split a $74 million (£57 million) reward.

In contrast, the UK’s existing reward system paid out just under £1 million in total last year, an amount deemed too low by many. Andrew Park, a tax investigations partner at Price Bailey, believes that “truly major frauds” are likely to remain hidden unless potential whistleblowers see meaningful returns: “They need a pretty major incentive to blow the whistle,” he said, noting that the risks can include exposure to criminal gangs.

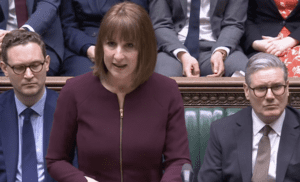

James Murray, Exchequer Secretary to the Treasury, emphasised that tax fraud “rips off everyone who plays by the rules”. He said: “As is the case in the US and Canada, our new approach will make sure people are incentivised to do the right thing and help the government tackle tax avoidance head on.” The government has allocated an additional £1.4 billion to HM Revenue & Customs over five years in a bid to boost the amount of tax collected.

Meanwhile, the Treasury plans to raise the threshold at which individuals with “side hustles” — such as online clothes sales, dog walking or gardening — must file self-assessment tax returns. By 2029, the limit will increase from £1,000 to £3,000, freeing around 300,000 taxpayers from annual returns. Ninety thousand people will also end up with no tax liability, while others will be able to settle what they owe via an online service.

Read more:

Treasury lays out multimillion-pound whistleblower rewards to tackle tax fraud