French digital artist Joanie Lemercier was, like so many in his field, seeking a new outlet for his work, but wanted to peddle it in an environmentally responsible way.

This required altering an approach that had resulted in him flying to various events (festivals, galleries, etc.) over the previous 15 years, as he wrote in his blog in February 2021.

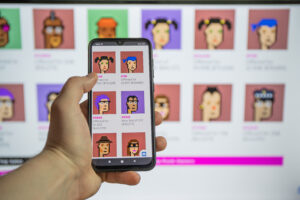

Ultimately, he settled on non-fungible tokens (NFTs) — essentially digital ownership certificates that enable artwork to be bought and sold via blockchains. And now, NFTs are certainly having a moment; Time Magazine reported that some $250 million of NFT-based artwork was sold in March 2021, after $200 million of such work had been sold in all of 2020. Particularly noteworthy was the sale of a piece by the artist known as Beeple (Matt Winkleman) for $69 million and Tim Berners-Lee’s NFT of world wide web source code sold for $5.4m.

Simply put, a digital code associated with the work is uploaded — i.e., “minted” — onto a blockchain (most often Ethereum) and then auctioned on an NFT marketplace such as Nifty Gateway, SuperRare, Open Sea and Makers Place. The seller is paid in cryptocurrency, which can then be exchanged for hard currency based on the going rate at any given time, in much the same way a traveler exchanges foreign currencies.

Marco Coffen, an experienced investor, tech strategist, and real estate developer explains that the appeal is obvious to artists who have for years been displaying their wares on platforms such as Facebook and Instagram, and seeing little in the way of profitability. While it is true that copies of works can still be made, the minting process ensures that the NFT cannot be. There can be only one owner of the original digital work, and one person capable of selling it. Duncan Cock Foster, who with his twin brother Griffin founded Nifty Gateway in 2017 (and launched it in 2020), summed it up as follows on the website Businessofbusiness.com:

“Anyone could print out the Mona Lisa and hang it up on the wall, but only one person or one museum has the actual, original Mona Lisa. Essentially, NFTs are just a way to make digital art collectible and scarce, the same way that physical art is.”

The downside is, however, a dramatic one — as Lemercier himself discovered. By eliminating air travel, he had hoped to reduce his carbon footprint by 10% per year, and was on target to reach his goal, until he discovered that by selling six pieces of digital art, he was using more electricity than his studio consumed in two years.

That’s because an enormous amount of computing power is used to mint a work of art. Ethereum, in fact, employs a method known as “proof of work” that is by design inefficient, for competitive and security reasons. The result is that that blockchain gobbles up 44.94 terawatt-hours of electrical energy each year, as much as nations like Qatar and Hungary consume annually, and emits 21.35 metric tons of carbon dioxide, as much as Sudan.

Certainly, though, it is essential to find some sort of happy medium — to avail digital artists of an outlet for their work, while at the same time curtailing the adverse impact NFTs make on the planet.

Amy Whitaker, an assistant professor of visual arts administration at New York University, pointed out to Time that new technologies are “always really imperfect in their rollout; they can have a speculative boom, and people can misuse them in unsavory ways.” Tweaks like the following are possible steps toward curtailing the detrimental effect NFTs are having on the environment:

Ethereum 2.0:

This upgrade is in progress, and likely “still years away” from being fully implemented. But when it occurs it will feature “proof of stake” protocols that will result in minting consuming 99.95% less energy than is currently the case, according to an estimate on the Ethereum Foundation’s blog.

Lazy Minting:

This is a practice by which the NFT isn’t minted until its initial purchase. The artist or system administrator authorizes the user to do so upon completion of the transaction, and it is estimated that that reduces the carbon footprint by two to three times.

Sidechains:

NFTs are minted on proof-of-stake blockchains that are attached to a parent blockchain like Ethereum. This enables the NFTs to be moved when a transaction is consummated, and it is estimated that this process is hundreds of times more energy-efficient than proof-of-work practices.

Bridges:

This process makes interoperability possible between two blockchains that normally cannot interact. Data can be minted on Ethereum and moved to another chain that is less deleterious to the environment.

Layer Scaling Optimizations (a.k.a. Layer 2 Scaling):

Described as a triaging mechanism, in that these solutions enable transactions to be offloaded from Ethereum, increasing the network’s speed and greatly reducing its carbon footprint to a degree comparable to that of sidechains.

Carbon Offsets:

This practice calls upon those who create an NFT to make a payment toward a sustainable project like a wind farm or tree-planting initiative, the hope being that the buyer can counter the carbon emissions he or she is causing. There are those who argue that the positive aspects of such projects might not be seen until years after the damage is done.

Clearly, action is required, and soon. For while NFTs offer the artistic community tremendous benefit, their downside is too ominous to contemplate.

Read more:

The delicate balance between NFTs and the environment